However, most of those small pop up groups lack large capital to service the broader group and due to this fact, extraordinarily restricted of their offerings. Islamic banking and finance has been out there in Australia for the final 30 years via multiple funding traces. However, as of 2024 there's NO official Islamic Bank in Australia with a banking license. Additionally, there have been some unsuccessful attempts to create an area Islamic bank, but this has not been forthcoming or achievable despite the pleasure of the community in Australia at this risk. Australia's finance sector is tapping into the Islamic market, with one of the country's greatest lenders launching a Sharia-compliant loan. Specialised banking providers for Muslim businesses and group organisations.

- During this lease time period, the customer pays rent to the institution, which can embrace an ownership share element.

- However, they lately announced that they have withdrawn their home finance choices.

- The department understands BPJPH intend to conduct an extra collective MRA signing with HCBs previous to October 2024.

- There are additionally more and more extra on-line platforms that cater to global prospects in search of Islamic financial products, making it simpler for these in areas with fewer local choices.

- Shari'ah compliance is of utmost significance within the realm of halal financing.

Personal Finance

We provide customized Islamic home financing solutions created that can assist you buy your dream home while strictly adhering to your Islamic values. As a Shariah-compliance institution, we offer aggressive pricing and values-driven Islamic mortgages, supplying you with the chance to be one step closer to your goals. Under the commodity murabaha mannequin, when a buyer approaches a financial institution for an Islamic financing of his property, the financial institution will first sell him a commodity such as palm oil, cocoa and the like.

Halal Mortgage

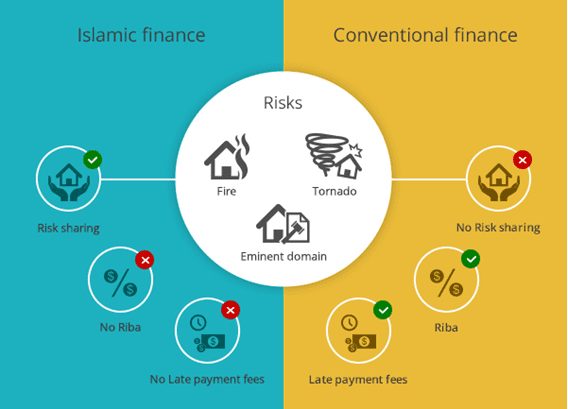

In a Murabaha transaction, the monetary institution purchases the property on behalf of the customer and then sells it back at the next worth, permitting the buyer to pay in installments. This method allows Muslim homebuyers to acquire property with out interest, which is prohibited in Islamic finance. As Islamic financing is based on ethical principles and the values of Islam, interest, gambling, uncertainty in contracts and the funding of companies and providers seen as harmful are prohibited. LVR is the amount of your loan compared to the Bank’s valuation of your property provided to safe your loan expressed as a percentage. Home loan charges for brand new loans are set based on the preliminary LVR and won’t change through the lifetime of the loan because the LVR changes.

How Does Islamic Home Loan Work?

As one of the most trusted Islamic home loan suppliers, our specialists are skilled and skilled in refinancing all forms of typical home loans. We are absolutely conscious of the right steps to refinancing houses the Halal Way. Our Halal home refinancing team will even allow you to deal with the robust enterprise of deciding which refinancing product suit your needs and targets as nicely. Through our Islamic refinancing options, you'll be able to rest assured of reasonably priced monthly payments or shortened cost time period, so you presumably can lastly have a home to call your individual. Rather than an interest-based loan that includes illegal improve in the valuation of property, we at Devon Islamic Finance provide refinancing products set in an interest-free and equitable association. We provide our refinance companies to Muslims and non-Muslims who wish to change from conventional to Halal mortgage, with the added benefit of home equity.

Anyone, Muslim or non-Muslim can apply for finance, however approval of funds is topic to assembly the relevant evaluation standards in drive on the time of application. We will be unable to proceed any additional with your application if you do not promptly provide all of the required/requested documentation/information. MCCA stands other than some other finance choice open to Australia’s Muslims due to its competitive pricing and values-driven ethos. We are dedicated to providing you with the bottom priced, independently Shariah certified property finance in Australia. Ethical financing plays a vital role in meeting financial wants and making a sustainable financial landscape. In at present's world, the place financial challenges are prevalent, it's crucial to consider the ethical dimensions of our financial decisio...